Guide To Private Health Insurance

In the United Kingdom, while most residents are entitled to free healthcare through the NHS, many opt to supplement their coverage with private medical insurance. This additional insurance covers the costs of treatment from private healthcare providers. In this guide, we'll delve into the intricacies of private health insurance, including what it entails, what it covers, considerations for selecting a plan, and alternative options.

What is Private Health Insurance?

Private health insurance, also referred to as private medical insurance, covers some or all of your medical expenses if you choose to receive treatment privately. It grants you the freedom to select the level of care you receive and when and how it's provided. Without it, opting for private treatment can be prohibitively expensive, particularly for serious conditions.

Coverage Offered by Private Health Insurance

The coverage provided by private medical insurance varies depending on the policy and provider. Basic policies typically cover most in-patient treatments, such as tests and surgeries, along with day-care procedures. Some policies extend to out-patient treatments, including consultations with specialists, and may offer a fixed amount for each night spent in an NHS hospital.

What Isn't Covered?

Private health insurance typically does not cover certain treatments, including organ transplants, pre-existing medical conditions, pregnancy and childbirth expenses, cosmetic surgery, injuries from dangerous sports or war, and chronic illnesses such as HIV/AIDS, diabetes, and epilepsy. Mental health, depression, and sports injuries may or may not be covered depending on the policy.

How to Choose a Private Health Insurance Plan

Private medical insurance may be offered as part of employee benefit packages by employers. Alternatively, individuals can purchase it from insurers, brokers, financial advisers, banks, building societies, or even retailers. Experts at WeCovr help people like you find the most suitable plan for free on a daily basis.

Do You Need Private Health Insurance?

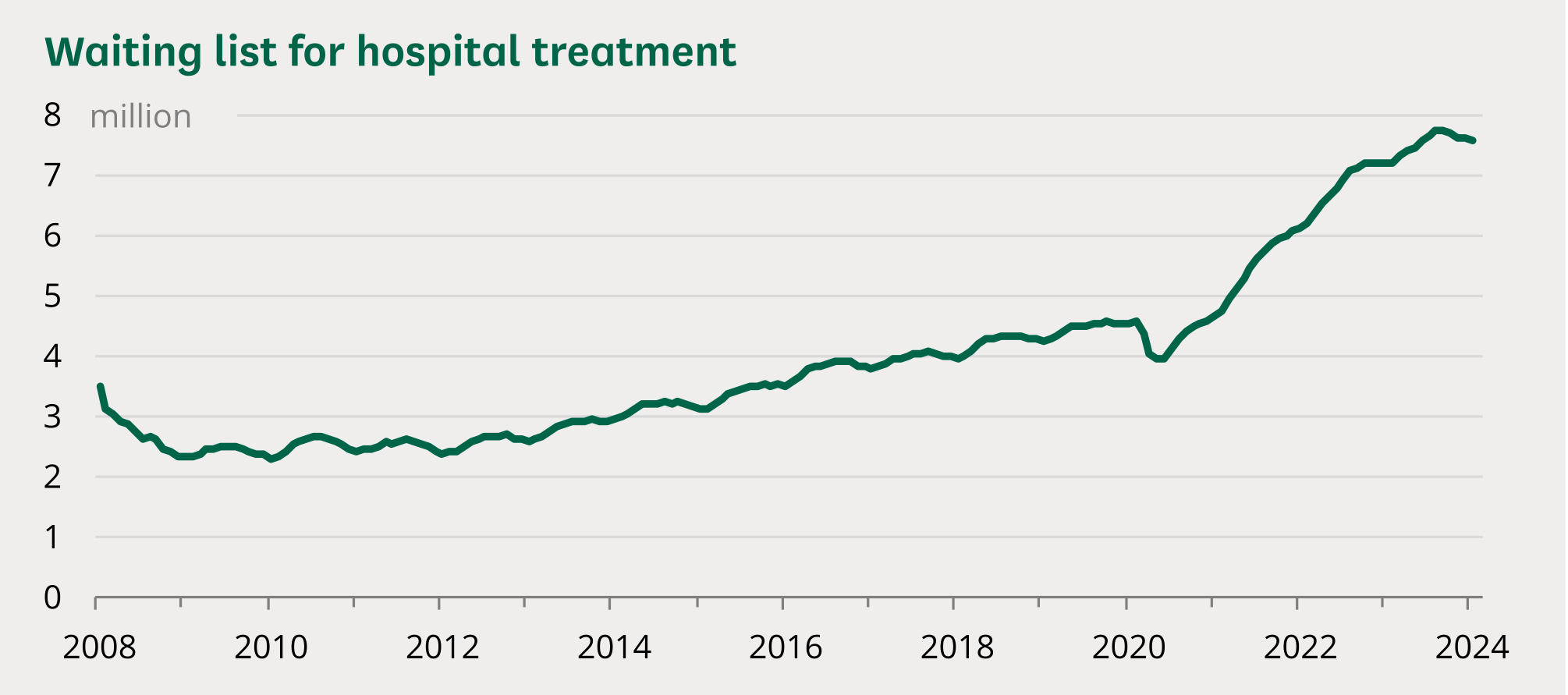

The decision to opt for private health insurance is personal. It becomes necessary if you prefer not to wait for NHS treatment, would rather receive treatment in private hospitals, or seek coverage for drugs and treatments unavailable through the NHS. The waiting list for hospital treatment within NHS rose to a record of nearly 7.8 million in September 2023 and continued to grow.

Rising NHS Waiting Lists Spur Demand for Private Health Insurance

Pros and Cons of Private Health Insurance

Pros:

- Specialist referrals and second opinions

- Expedited scans and reduced waiting times for treatment

- Choice of surgeon and hospital

- Potential access to specialist drugs and treatments

- Private room accommodation

- Quicker access to physiotherapy

Cons:

- NHS care may be as good as private care for serious illnesses

- Exclusion of chronic illnesses and pre-existing conditions

- Premiums may not be always affordable for everyone

Alternative Options

In light of the coronavirus pandemic, private medical insurers have adapted their policies to accommodate changing circumstances, including refunds or premium suspensions. Individuals seeking alternatives to private insurance can consider using savings for medical costs, paying for private consultations, or exploring income protection insurance to safeguard against financial hardship during illness or injury. At WeCovr, we can provide free consultations for people interested in income protection as well as private health insurance.

Five Considerations When Buying Private Health Insurance

- Seek professional advice to navigate the complexities of insurance options.

- Explore cost-saving measures, such as policies that kick in when NHS treatment delays exceed a certain period.

- Assess the feasibility of switching insurers, considering changes in risk profile and medical history.

- Provide accurate medical history to avoid claim rejections or policy cancellations.

- Scrutinise policy details, including coverage limits, excess options, and exclusions, and seek clarification when necessary.

Other Types of Insurance to Consider

In addition to private health insurance, individuals should prioritise insurance that safeguards against financial hardship during illness or injury. Income protection insurance, for instance, can provide peace of mind by ensuring mortgage payments and bills are covered in such circumstances.

Navigating the realm of private health insurance requires careful consideration of individual needs, financial circumstances, and available options. By understanding the nuances of private medical insurance, individuals can make informed decisions to secure their health and financial well-being.